A SOC 1 Type 2 report is more than just a certificate on the wall. It’s an independent auditor’s stamp of approval, confirming that your company's internal controls over financial reporting are not only designed properly but have actually worked as intended over a set period of time—usually 6 to 12 months. This gives your clients solid assurance that their financial data is in safe hands, helping you close bigger deals faster.

Understanding the SOC 1 Type 2 Report and Its Business Impact

Picture this: you're on the verge of closing a massive deal, and the enterprise client suddenly asks for your SOC 1 report. For many SMBs and startups, that request can feel like a huge, unexpected roadblock that kills your momentum. But once you understand what this report really is, you can turn a compliance headache into a serious competitive edge.

Think of a SOC 1 Type 2 report as a detailed story about your company's reliability over time. It’s a bit like a home inspection, but much more thorough. A basic inspection checks the blueprints to see if the house should be structurally sound (that's the design of your controls). A Type 2 audit, however, lives in the house for a year—through storms and sunshine—to see how it actually holds up under pressure (that's the operating effectiveness of your controls).

More Than Just a Compliance Checkbox

If your business handles any data that could affect a client's financial statements—think payroll processing, revenue management, or SaaS billing platforms—this report is essential. It's the concrete evidence that proves your internal processes are sound and trustworthy. For startups and smaller companies, earning this attestation is a major milestone that builds instant credibility and helps you go toe-to-toe with the big players.

This isn’t just about passing an audit; it's about building a foundation of trust that can genuinely speed up your sales process. When you can hand over a clean SOC 1 Type 2 report right at the start of a sales conversation, you immediately answer a major question for your prospects, especially large enterprises. That confidence delivers some real-world benefits:

- Faster Sales Cycles: Stop getting bogged down by endless security questionnaires. A SOC 1 report provides one comprehensive, auditor-verified document that answers most of their questions at once.

- Unlock Enterprise Deals: Large, regulated companies won't even consider vendors without this level of assurance. A SOC 1 report gets you on the approved vendor list.

- Competitive Advantage: Having this report ready can be the very thing that makes a client choose you over a competitor who is stuck in compliance limbo.

In short, a SOC 1 Type 2 report turns a daunting compliance task into a powerful sales asset. It's an investment in your reputation that unlocks bigger deals and builds lasting client relationships.

Across France, the growing demand for SOC 1 Type 2 compliance highlights a major shift towards transparency and building stakeholder confidence. These reports, which assess how well controls have worked over several months, offer much stronger assurance than a simple point-in-time check. They provide detailed proof that you're not just talking the talk, but walking the walk. You can find more specific insights about SOC 1 certification in France if you're looking for regional details.

Choosing the Right Audit: SOC 1 vs SOC 2 and Type 1 vs Type 2

Trying to figure out which compliance report you need can feel like you’re lost in an alphabet soup of acronyms. It’s a common frustration, but picking the wrong one is a genuinely costly mistake, especially for SMBs and startups where every dollar and hour counts. Wasting months of effort and a significant budget on the wrong audit is a painful setback that stalls growth.

The key is to break it down. Think of the reports as two separate decisions: first, SOC 1 versus SOC 2, and second, Type 1 versus Type 2. Get these two choices right, and you'll have exactly what your clients are asking for.

SOC 1 vs SOC 2: What's the Core Focus?

The biggest difference between SOC 1 and SOC 2 is what they're designed to examine. The right choice depends entirely on how your services connect with your clients' business operations.

SOC 1 is all about Internal Control over Financial Reporting (ICFR). If your service touches anything that could impact a client’s financial statements, this is for you. Think payroll processing, revenue management, or claims administration. Your system's accuracy directly affects their books.

SOC 2 has a much wider brief. It focuses on controls related to one or more of the five Trust Services Criteria: Security, Availability, Processing Integrity, Confidentiality, and Privacy. This report is for any company that handles, stores, or processes sensitive customer data where operational security is the main concern.

So, the simple way to think about it is: SOC 1 is for financial trust, and SOC 2 is for operational and data security trust. If you want to dig deeper into the latter, our guide to understanding SOC 2 compliance is a great resource. This is your first and most important decision.

Type 1 vs Type 2: A Snapshot vs a Film

After you’ve settled on SOC 1 or SOC 2, you need to decide on the type. This choice determines the depth of assurance you're providing to your clients.

A Type 1 report is like a photograph. It captures a single moment, assessing the design of your controls at a specific point in time. It essentially confirms that, on paper, you have the right policies and procedures in place on a given day.

A Type 1 is a decent first step, but it doesn't prove that your controls are actually being followed. It shows you have a good plan, not that the plan works. Many enterprise customers will see it as insufficient.

A Type 2 report is more like a film. It doesn't just look at the design; it tests the operating effectiveness of your controls over a period of time, usually between six and twelve months. This is the gold standard that most serious customers and partners will ask for.

A SOC 1 Type 2 report, therefore, offers the highest level of assurance for financial controls. It tells your clients that your systems have been put through their paces and have proven to be effective and reliable over the long haul. This kind of proof is incredibly powerful for building trust and shortening sales cycles.

SOC Audit Comparison at a Glance

To make it even clearer, this table breaks down the key differences between the most common SOC reports. It’s a quick way to see which audit aligns with your business needs and what you're trying to prove to your customers.

| Attribute | SOC 1 Type 1 | SOC 1 Type 2 | SOC 2 Type 2 |

|---|---|---|---|

| Primary Focus | Financial Reporting Controls | Financial Reporting Controls | Security & Operational Controls |

| Evaluation Scope | Design of controls | Design and operating effectiveness of controls | Design and operating effectiveness of controls |

| Time Period | A single point in time ("snapshot") | Over a period (typically 6-12 months) | Over a period (typically 6-12 months) |

| Client Assurance | Moderate | High | High |

Ultimately, understanding these distinctions helps you invest your compliance budget wisely and give your customers the exact proof of security and reliability they're looking for.

So, Who Actually Needs a SOC 1 Type 2 Report?

Let's cut through the jargon. The real question for any growing business is simple: do we need one of these? For a SOC 1 Type 2 report, the answer is refreshingly straightforward. If your service has any kind of impact on your clients' financial statements, you’re almost certainly a candidate.

And we're not just talking about directly handling money. This applies to any system that processes, stores, or touches data that could find its way into a customer's financial reporting. Without this report, you'll start hitting major roadblocks in your sales process, especially when you're trying to land larger, publicly traded companies that live under their own strict compliance rules.

Clear Signs It's Time for a SOC 1

Think of these as flashing lights on your business dashboard. If you start seeing any of these, it's time to get serious about the SOC 1 process.

- You're buried in security questionnaires from financial clients. When potential customers in banking, insurance, or any public company start sending you detailed checklists about your internal controls over financial reporting, what they're really asking for is a SOC 1 report.

- A client tells you you're part of their SOX compliance. If a public company relies on your service to meet their Sarbanes-Oxley (SOX) obligations, their auditors will demand proof that your controls are solid. A SOC 1 is the standard, accepted way to provide that proof.

- You're making a play for the financial services industry. Want to break into this high-value market? You have to play by their rules. A SOC 1 Type 2 report is essentially the price of admission; it shows you understand and meet their incredibly high standards for financial data integrity.

Real-World Examples of Who Needs This

Let's make this more concrete. If your company fits into one of these buckets, a SOC 1 Type 2 report isn't a "nice-to-have"—it's a critical tool for scaling your business.

- Payroll Processors: You're calculating wages, taxes, and deductions. Every single one of those numbers directly affects your client's payroll expenses and liabilities on their balance sheet.

- SaaS Billing Platforms: Your software is the engine behind your client's revenue. It manages subscriptions, calculates what's owed, and generates invoices, all of which are central to their revenue recognition.

- Data Centres Hosting Financial Apps: If a client runs their accounting software on your infrastructure, your controls over that environment are just as important as their own. Their auditors will want to see your report.

- Claims Administrators: Whether you're in insurance or healthcare, processing a claim creates a direct financial event for your client—an expense, a liability, a payment.

It's easy for a startup or a growing business to see a SOC 1 Type 2 audit as just another compliance hoop to jump through. That’s a mistake. Think of it as a powerful strategic asset. Having this report ready before a big prospect asks for it flips the script—it turns a potential sales dealbreaker into a competitive advantage, helping you unlock enterprise contracts and build the kind of trust you need to go head-to-head with the big, established players.

Your Roadmap for the First SOC 1 Type 2 Audit

Stepping into your first SOC 1 Type 2 audit can feel a bit like setting off on a major expedition. It's a significant undertaking with several distinct stages, and without a clear map, it’s easy to get lost. Let's break down the journey into four clear phases, turning what seems like a monumental task into a manageable, step-by-step project.

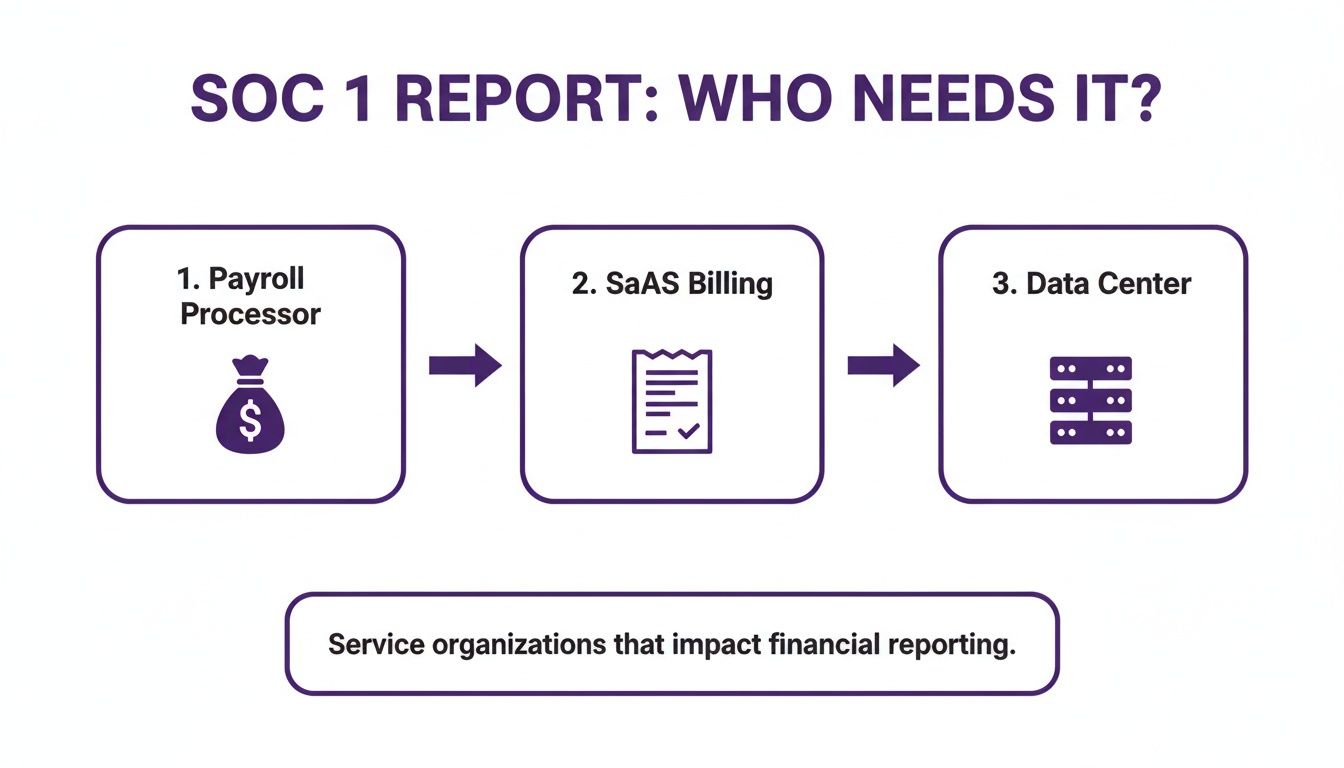

This image highlights the kinds of businesses that need a SOC 1 report—think payroll processors, SaaS billing platforms, or even data centres. The key takeaway is simple: if your service produces data that your clients use in their financial reporting, a SOC 1 audit is likely on your horizon.

Phase 1: Readiness and Scoping

This is where the groundwork is laid, and honestly, it’s the most important phase for ensuring a smooth audit. Get this part right, and you'll save yourself a world of headaches later on. Think of it as drawing the map before you start your journey.

The main goal here is to sit down with an auditor and clearly define your control objectives. These are the high-level goals your internal controls need to achieve, like making sure only authorised personnel can access sensitive financial data. From there, you'll map your current processes and policies against these objectives to see where you stand.

Key activities include:

- Selecting an Audit Firm: Find a reputable CPA firm that knows your industry inside and out.

- Defining the Audit Scope: Decide precisely which systems, processes, and locations will be under the microscope.

- Conducting a Readiness Assessment: This is basically a dress rehearsal. It’s a pre-audit check-up to spot any control gaps before the real thing kicks off.

Phase 2: Control Remediation

The readiness assessment will almost always turn up a few gaps between what you're doing and what the audit requires. Don't panic; this is completely normal. The remediation phase is your chance to fix these issues before the auditors start their official testing.

During this stage, your technical and operational teams will be front and centre. They'll be busy implementing new controls, tightening up policies, and getting procedures documented. For instance, you might discover you need to formalise your change management process or put a more robust user access review system in place. This proactive effort is crucial for getting a clean audit report.

Phase 3: The Observation Period

Now for the main event. A SOC 1 Type 2 audit isn’t a quick snapshot; it’s more like a feature film. It involves an extended observation period, usually running for six to twelve months. Throughout this time, your auditor will be actively testing your controls to confirm they are working effectively and consistently.

The biggest challenge for most companies here is evidence collection. Auditors will ask for proof that your controls have been operating without fail, which can mean digging up hundreds of screenshots, system logs, and official documents. This manual evidence gathering is a massive time sink for your team.

This is where compliance automation platforms really shine. They can save you hundreds of hours by continuously gathering and organising the necessary evidence. Consistent, thorough documentation is the only way to prove your controls are effective over time. To get a better feel for how different tools can help, you can explore relevant use cases.

Phase 4: Final Reporting

Once the observation period ends, the auditor gets to work compiling everything into the final SOC 1 Type 2 report. This document details their opinion on the design and operating effectiveness of your controls. It will also describe the tests they performed and what they found. If any controls failed during testing, they'll be listed as "exceptions," alongside a response from your management team.

For a broader perspective on how these audits generally unfold, our guide on how SOC 2 audits are conducted offers some great insights.

Be prepared for a significant time commitment. For example, organisations in France pursuing SOC 1 Type 2 should plan for a structured timeline of 8-10 weeks for the audit work itself. For a mid-sized company, costs often average around $9,750 USD.

What Auditors Actually Look For: Key Controls and Objectives in a SOC 1 Audit

Let's move away from abstract compliance theory and get into what a SOC 1 Type 2 audit actually looks like on the ground. This isn't just about having well-written policies. Auditors are there to test the real-world controls you have in place to protect your clients' financial data.

For many businesses facing their first audit, the biggest worry is the unknown. What exactly will the auditors scrutinise? The answer is a structured set of control objectives that cover everything from your company culture to your server configurations. Breaking these down gives you a clear roadmap for what your teams need to do.

The Three Pillars of a Strong Audit

Auditors tend to group controls into a few logical areas. Think of these as the main chapters in your company's compliance story. While every business is a bit different, most audits will focus heavily on three core areas that work together to protect financial data.

These aren't just separate checklists to tick off; they're interconnected parts of a single, robust system.

The Control Environment: This is the bedrock of your entire security posture. It’s about the big picture—your company’s code of conduct, your commitment to ethical behaviour, and how you're structured. Auditors want to see proof that security is part of your DNA, looking at things like mandatory security awareness training records for all employees.

Risk Assessment: This section is all about showing you’re proactive. You need a formal, documented process for finding, analysing, and dealing with risks that could mess up your clients' financial reporting. For a SaaS company, a classic example would be assessing the risk of a data breach in the database that handles customer billing information.

Control Activities: Here's where we get into the nuts and bolts. These are the specific, tangible actions, policies, and procedures you use to counter the risks you’ve found. This is often the most detailed part of the audit, as it covers the daily operational safeguards that keep data safe.

Real-World Examples of Testable Controls

To make this crystal clear, let's look at some specific control activities an auditor would want to test. These are the exact kinds of things a CTO or Head of Security needs to have locked down, documented, and consistently followed.

Logical Access Controls: This is all about who can get into what. A very common control an auditor would test is: "Access to production databases containing financial data is restricted to authorised personnel based on their job function and is reviewed quarterly."

Change Management: Auditors need to see that you aren’t making changes to your systems on the fly. A typical control might state: "All changes to the production environment follow a documented approval process, including peer review and testing before deployment."

Data Backup and Recovery: You have to prove you can get back on your feet after a disaster. A control objective for this could be: "Data backups are performed daily, stored securely offsite, and recovery procedures are tested at least annually to ensure data integrity."

If your service relies on other vendors or subservice organisations, your controls for managing those relationships become critical. Having a formal process for contracting with suppliers is vital for ensuring the integrity of the entire financial reporting chain.

Ultimately, a SOC 1 audit isn’t about being perfect from day one. It's about showing that you have a mature, deliberate, and repeatable process for managing the security and integrity of the financial data your clients trust you with. Understanding these key control areas helps take the fear out of the audit and gives you a clear path forward.

Your Actionable Pre-Audit Success Checklist

Getting ready for a SOC 1 Type 2 audit can often feel like controlled chaos. All too often, it descends into a last-minute scramble to hunt down documents and prove that controls are actually working as intended. The secret to a successful outcome is transforming this stressful rush into a well-managed, structured project.

This checklist gives you a clear, practical framework to guide your team through the process. By following these steps, you can take charge internally, sidestep costly surprises, and walk into your audit with real confidence.

1. Define a Precise Audit Scope

Before you even think about gathering evidence, you need to nail down exactly what the audit will cover. This is hands-down the most important step for preventing scope creep, a notorious problem that can send audit costs and effort through the roof.

Work with your key stakeholders and your chosen auditor to finalise and document:

- Which systems are in scope? Be specific. Is it just the billing platform, or the production databases as well?

- Which business processes are included? Think about client onboarding, data processing, and any other relevant workflows.

- Which physical locations will be audited? This could be your corporate office or specific data centres.

A tightly defined scope keeps everyone on the same page and ensures the final report is genuinely relevant to what your clients need to see.

2. Assign Internal Control Owners

Compliance is a team sport. It's not a one-person show. For every key control area, you need to assign a specific individual to be the "owner". This simple act creates clear accountability and ensures that when an auditor asks for evidence, someone is ready to provide it.

Think of it like this:

- The Head of Engineering naturally owns controls around change management and data backups.

- Your HR Manager is the perfect owner for employee onboarding and security training controls.

- The CTO is typically responsible for logical access and overarching risk assessments.

Distributing responsibility this way prevents bottlenecks and empowers the subject matter experts in each department to prepare their evidence far more effectively.

3. Conduct a Proactive Gap Analysis

Don't wait for your auditor to be the one who finds your weaknesses. A gap analysis is essentially a dress rehearsal, a pre-audit review where you measure your existing controls against the actual SOC 1 requirements. The goal here is simple: find and fix problems before the official audit period begins.

This is your single best chance to catch issues like undocumented procedures, missed access reviews, or inconsistent policy enforcement. This process ties directly into broader risk strategies, which you can explore in our guide on conducting a business impact analysis.

A thorough gap analysis is the difference between a smooth audit and one filled with unwelcome surprises. It's an investment that pays for itself by minimising the risk of control exceptions in your final report.

4. Organise Your Documentation Centrally

Auditors live and breathe evidence. One of the biggest time-wasters during any audit is disorganised documentation. Before your observation period kicks off, take the time to gather and centralise all your relevant policies, procedures, and process documents.

Set up a secure, shared repository for essentials like your:

- Information Security Policy

- Acceptable Use Policy

- Incident Response Plan

- Employee Code of Conduct

For service organisations in France, SOC 1 Type 2 audits have become a vital compliance standard, with annual evaluations now the norm. These audits confirm that controls have been effective over a 6 to 12-month period, giving stakeholders robust assurance over financial reporting.

5. Leverage a Compliance Automation Platform

Trying to manually collect evidence from a six or twelve-month period is a monumental task, not to mention incredibly prone to human error. This is where modern compliance platforms become so valuable, especially for startups and smaller businesses with lean teams.

These tools can automate evidence collection, map it directly to the right controls, and act as a central hub for communication with your auditors. By automating the grunt work, you free up your team to focus on what matters—strengthening controls, not chasing down screenshots. This one strategic move can dramatically reduce the internal burden of your SOC 1 Type 2 audit.

Common Questions About SOC 1 Type 2

When you're diving into your first SOC 1 Type 2 audit, a lot of practical questions will come up. This is especially true for startups and growing businesses where every decision about time and budget is scrutinised. Getting straight answers is the best way to plan your audit journey and sidestep any nasty surprises. Let’s tackle some of the most common questions we hear.

How Much Should We Budget For a SOC 1 Type 2 Audit?

There's no one-size-fits-all answer here. The cost really depends on the size of your company, how complex your systems are, and the exact scope of the audit. That said, for a typical small to mid-sized business, you should plan to spend between €6,000 and €10,000 on the auditor's fees alone.

But be careful not to just focus on the auditor's bill. A realistic budget needs to cover a few other key areas:

- Your Team's Time: The hidden cost of an audit is the hundreds of hours your engineering, security, and management teams will spend on preparation, evidence gathering, and interviews.

- Remediation Costs: You'll likely uncover control gaps during your readiness assessment. You might need to invest in new security software or make other changes, which all comes with a price tag.

- Compliance Tools: While optional, investing in compliance automation software can be a game-changer. It might seem like an extra cost upfront, but it can drastically reduce the long-term expense of manual work and speed up the entire process.

How Long Does The Whole SOC 1 Type 2 Process Take?

It’s a marathon, not a sprint. From the moment you commit to getting a SOC 1 Type 2 report to holding the final document, the entire journey usually takes somewhere between six and fifteen months. It sounds like a long time, but it’s broken down into manageable phases.

Here’s what a typical timeline looks like:

- Scoping and Readiness (1-3 months): This is where you lay the groundwork. You’ll work with your chosen auditor to define the scope and perform a gap analysis to see where you stand.

- Remediation (1-3 months): Now it's time to fix any issues you found during the readiness phase.

- Observation Period (6-12 months): This is the heart of the Type 2 audit. The auditor will test your controls as they operate in real-time over this extended period.

- Final Reporting (4-6 weeks): Once the observation period is over, the auditor gathers their findings, writes everything up, and delivers your final report.

If there's one thing to take away, it's this: start the process long before a major client asks for the report. You simply cannot fast-track the observation period.

What Happens If One of Our Controls Fails?

First off, don't panic. Finding a control failure, what auditors call an "exception," doesn’t mean you’ve failed the entire audit. It's actually pretty common, especially for companies going through it for the first time.

When an auditor finds an issue, they'll document it in the report. Your job is to provide a formal management response, which also gets included in the final report. In your response, you'll need to explain why the control failed and lay out the steps you've taken to fix it and make sure it doesn’t happen again. For your clients, seeing a transparent and well-documented response often shows maturity and a real commitment to improvement, which can be just as reassuring as a perfectly clean report.

Juggling compliance frameworks like SOC 1, ISO 27001, NIS 2, and DORA while fielding endless security questionnaires can easily overwhelm any startup or SMB team. Compli.st is an AI-powered compliance platform designed to automate these heavy lifts. We help you get audit-ready faster, complete client security questionnaires in minutes, and create a public Trust Center to build confidence and cut down on inbound requests. Find out how you can close deals faster and simplify your compliance journey by visiting the Compli.st website.